This page contains automatically translated content.

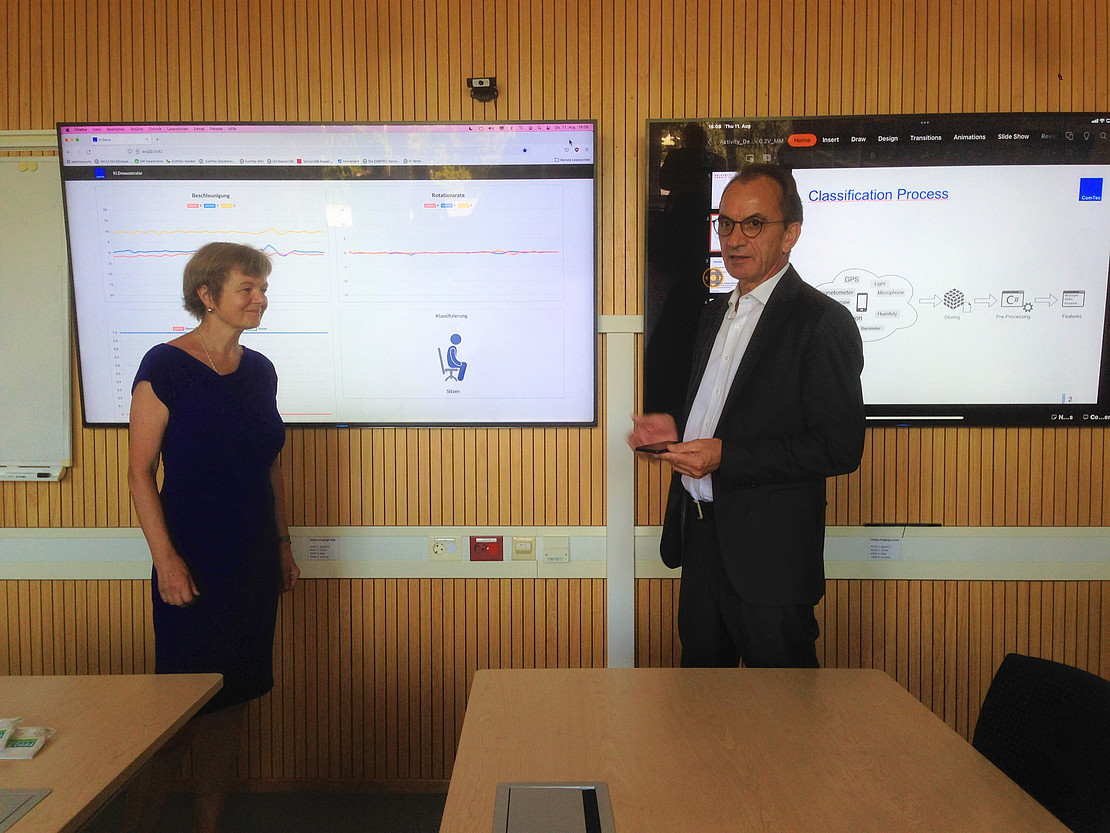

Minister of Finance Boddenberg informs himself about cooperation

Image: University of Kassel.

Image: University of Kassel."The central Hesse-wide responsibility of our tax administration for data acquisitions of evidence and for large-scale digital procedures is located here in Kassel. Since 2019, the Kassel II-Hofgeismar tax office has already been offering a bachelor's degree in computer science in a practical alliance in cooperation with the University of Kassel. For us, it is obvious that we will need even more well-trained IT specialists in the future for the dedicated fight against tax crime. In 2021, we therefore also established a new professorship for information security, which we as the tax administration support with 250,000 euros annually," explained the Finance Minister.

For even more tax justice

In order to recruit young IT talent, five to six IT students are hired each year at the Kassel tax office. During the practical phases, they are trained in the IT forensics department of the tax investigation unit and support the team of IT investigators in their task of ensuring that electronic evidence is secured in a court-approved manner. After completing their studies, the graduates will support the IT forensics of the tax investigation unit and the research unit for artificial intelligence at the Kassel II-Hofgeismar tax office. Starting in the winter semester of 2022, the Kassel II-Hofgeismar Tax Office will also offer the master's degree in computer science in a practical alliance with the University of Kassel. "In this way, we would like to promote particularly committed and talented IT specialists who want to work together with their colleagues on site for even more tax justice in Hesse and thus for our community," he said. By cooperating with the university, the tax administration is breaking new ground together with a strong partner in order to be best equipped to meet the challenges of digitization.

Professor Dr. Ute Clement, President of the University of Kassel, commented: "In Kassel, we attach great importance to socially relevant research and teaching, and the Department of Electrical Engineering/Computer Science is known for preparing its graduates in the best possible way for the dynamic challenges of the present. With professorships in Big Data, Intelligent Embedded Systems, Artificial Intelligence and the new professorship in Information Security, the department can offer exactly what future IT experts in tax investigation need."

Excellent training structures

From the perspective of the Kassel II-Hofgeismar Tax Office, Office Manager Jörg Schlemmer reported, "Thanks to excellent training structures at the Kassel II-Hofgeismar Tax Office, the very good cooperation with the University of Kassel and the location advantage in the region for the selection process, I am particularly pleased that our students are among the best in the course. The computer scientists who are trained in the practical alliance can meet needs precisely and also open up innovative fields of activity. Kassel is a future location for computer science at the highest level, I'm sure of it!"

At the end of his visit, Minister Boddenberg thanked the university management, the lecturers and the colleagues from the Kassel II-Hofgeismar tax office for their cooperation: "Today I was able to see for myself that we have created and continue to create a good starting point with the establishment of the two courses of study in order to be prepared for the increasing technical requirements of the preservation and processing of evidence in criminal tax proceedings. This is only possible if theory and practice are closely interlinked. I would like to sincerely thank all those involved for their willingness to ensure this and to continuously develop it in the coming years."